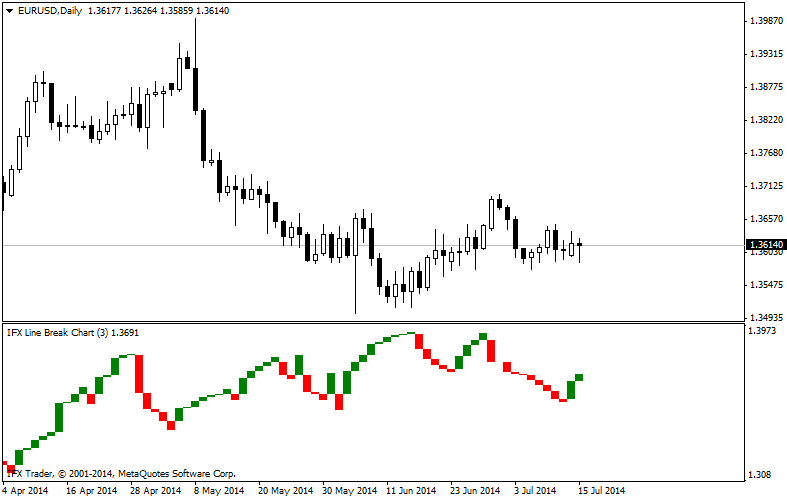

The Three Line Break charts are displayed in a separate window to gain clearer perception of signals. The TLB charts were first introduced by Steve Nison in his book Beyond Candlesticks in 1994.

Formula

Each new white line is drawn if the current Close t exceeds High t-1. The white line runs from the level of High t-1 to High t.

- Each new black line is drawn in case the current Close is below the price Low of the last trading day. The black line is drawn from the Low t-1 level to Low t.

- If each current Close t price does not exceed the trend or the change is not enough for reversal, no lines are added.

Trading use

Three Line Break charts display a series of vertical white and black lines or vertical boxes. White lines represent rising prices, while black lines portray falling prices. Three Line Break charts evolve based on price, not time.

The rules for a three-line break chart are the following:

- Buy when a white line appears after three adjacent black lines (a “white turnaround line”).

- Sell when a black line appears after three adjacent white lines (a “black turnaround line”).

- Refrain from trading when white lines alternate with black ones.

It is the price action which gives the indication of a reversal. The disadvantage of the TLB charts is that the signals of reversal appear after the new trend is underway.

You can adjust the time of delay between the periods when reversal signals occur. For short-term trading you can use 2-line breaks, while for long-term trading, you can make use of 4-line or even 10-line breaks.

Steve Nison recommends using the Three Line Break charts together with the Japanese candlesticks. The TLB charts will help you to determine the prevailing trends, while the candlesticks will show the right time for entering or exiting the market.

TLB charts parameters:

LB = 3

Stay

Stay